Welcome to Lion's Ascent Advisors

At Lion's Ascent Advisors, we believe retirement isn’t the end of the journey, it’s the summit. It’s where your hard work, sacrifices, and wise decisions should come together to provide peace of mind, prosperity, and protection, for you and for those you love.

That’s why we specialize in powerful, proven financial strategies using Fixed Indexed Annuities and Indexed Universal Life (IUL) Insurance. These tools are designed to help you:

✓ Build tax-free retirement income

✓ Protect and grow your wealth safely

✓ Create legacy-driven death benefits for your family

✓ Enjoy guarantees that can withstand market volatility

🛡 Why "Lion's Ascent"?

The lion represents strength, leadership, and legacy. Our team takes pride in guiding individuals and families with the same courage and clarity, helping you rise to new heights in retirement planning with solutions built for

longevity, protection, and generational impact.

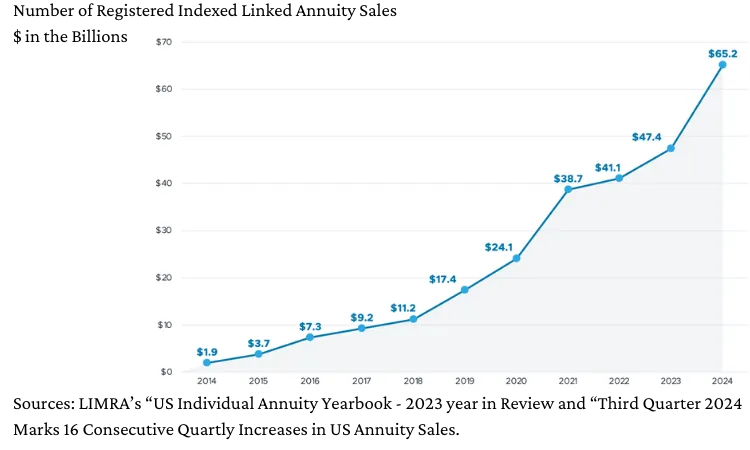

More and more retirees are turning to annuities as a core part of a well-rounded retirement plan and for good reason. With guaranteed income, protection from market downturns, and the ability to create a personal pension, annuities offer stability in an uncertain world.

As people live longer and seek smarter ways to manage longevity risk, annuities provide the confidence and consistency today’s retirees need to enjoy their golden years without outliving their savings.

At Lion's Ascent, we’re a team of seasoned professionals connected with the world’s leading annuity and IUL carriers. Our clients benefit from top-tier products, customized strategies, and the strength of trusted partnerships—all designed to protect legacies and elevate financial futures.

Secure Growth, Protected Future

Looking to grow your savings while reducing your exposure to market risk?

We offer strategies that provide tax-deferred growth potential all while protecting your money from market losses.

With a fixed annuity your principal is never affected by market downturns. Even when the market underperforms, your original investment remains intact, and the worst-case interest credit is simply zero, not a loss.

This kind of protection is especially important early in retirement, when a market drop can have the most serious long-term impact on your future income.

👨👩👧 Our Promise to You and Your Family

When you work with Lion's Ascent Advisors, you’re not just a client. You're family. Every financial strategy we build is tailored to your unique goals, values, and vision. We take the time to understand your situation and then walk alongside you every step of the way.

Because we’re not just protecting income, We’re protecting futures, legacies, and lives.

💡 What Makes an IUL So Unique?

At Lion's Ascent Advisors, we believe in doing things the right way, especially when it comes to life insurance strategies like Indexed Universal Life (IUL).

When structured properly, an IUL isn’t just insurance, it’s a powerful, flexible vehicle for tax-free retirement income, legacy planning, and long-term financial protection.

🛡 Designed for You. Not Just Sold to You.

Our team takes a custom, education-first approach structuring IULs for long-term performance, low cost, and real retirement value.

That means:

✓ Minimizing internal expenses and fees

✓ Maximizing early cash accumulation

✓ Prioritizing long-term sustainability over short-term commissions

We build your IUL strategy with the same care we’d use for our own family because we know what’s at stake.

🚀 Build Your Tax-Free Future with Confidence

If you’re looking for a retirement strategy that combines safety, growth, flexibility, and tax advantages, an IUL—done the right way—may be the foundation you’ve been searching for.

🧭 Is an IUL Right for You? Let’s Find Out Together.

IULs can be incredibly powerful—but only when they’re structured for the right person, with the right goals, and the right design.

At Lion's Ascent Advisors, we don’t believe in cookie-cutter solutions or one-size-fits-all sales pitches. Instead, we take the time to:

✓ Understand your long-term retirement goals

✓ Evaluate your current cash flow and liquidity

✓Model realistic outcomes, not inflated projections

✓Educate you every step of the way so you stay in control

We’ll also help you avoid the common mistakes that often lead to underperforming policies, like overfunding too late, poor carrier selection, or overly aggressive indexing strategies.

A Smarter, Safer Path to Tax-Free Retirement

An IUL policy offers:

✓ Tax-deferred growth of cash value

✓ Tax-free access to funds via policy loans

✓ Market-linked growth potential with downside protection

✓ A built-in death benefit to protect your family

Flexibility to adjust premiums and benefits as life evolves

But here’s the key: not all IULs are designed the same. That’s where we come in.

💬 What Our Clients Are Saying

Jonathan M., Business Owner | Austin, TX

“I always thought life insurance was just for death benefits, until Lion's Ascent Advisor Erik Leask showed me how an IUL could actually fund part of my retirement, tax-free. They walked me through every detail with patience and transparency. Now I have peace of mind knowing my family is protected and I’ve got a plan for the future.”

—

📈 Ready to Begin Your Ascent?

Start with a no-pressure consultation and learn how our Tax-Free Retirement Blueprint can give you confidence today and security tomorrow.

❓ Frequently Asked Questions: Fixed Indexed Annuities (FIAs)

1. What is a Fixed Indexed Annuity (FIA)?

A Fixed Indexed Annuity is a retirement product that offers tax-deferred growth, principal protection, and the opportunity to earn interest based on the performance of a market index—such as the S&P 500—without being directly invested in the market.

2. Is my principal at risk in an FIA?

No. With a Fixed Indexed Annuity, your principal is protected from market losses. Even if the index performs poorly, your account will never lose value due to market performance—the worst-case return is 0%, not negative.

3. How does the interest get credited?

Interest is credited based on the performance of the selected index, subject to a cap, spread, or participation rate. The better the index performs (up to those limits), the more interest you can earn.

4. Are there any fees?

Many FIAs come with no annual fees, but optional features like income riders or enhanced death benefits may come at an additional cost. We’ll help you understand any and all fees before you commit.

5. When can I access my money?

FIAs typically have a surrender period (usually 5–10 years) during which early withdrawals may incur penalties. However, most contracts allow penalty-free withdrawals of up to 10% annually after the first year.

6. Are FIAs good for generating retirement income?

Yes! Many FIAs offer lifetime income riders that can turn your annuity into a guaranteed stream of income you can’t outlive—helping protect against longevity risk.

7. How is an FIA different from a variable annuity?

Unlike variable annuities, FIAs do not expose your money to market risk. Your returns are based on index performance with built-in protection, while variable annuities can lose value if the market declines.

8. Are FIAs taxable?

Earnings grow tax-deferred, meaning you don’t pay taxes until you start taking withdrawals. When you do, earnings are taxed as ordinary income.

© Copyright 2026. Lion's Ascent . All rights reserved.